If the last decade was about digitizing communication and payments, the next decade is about digitizing ownership.

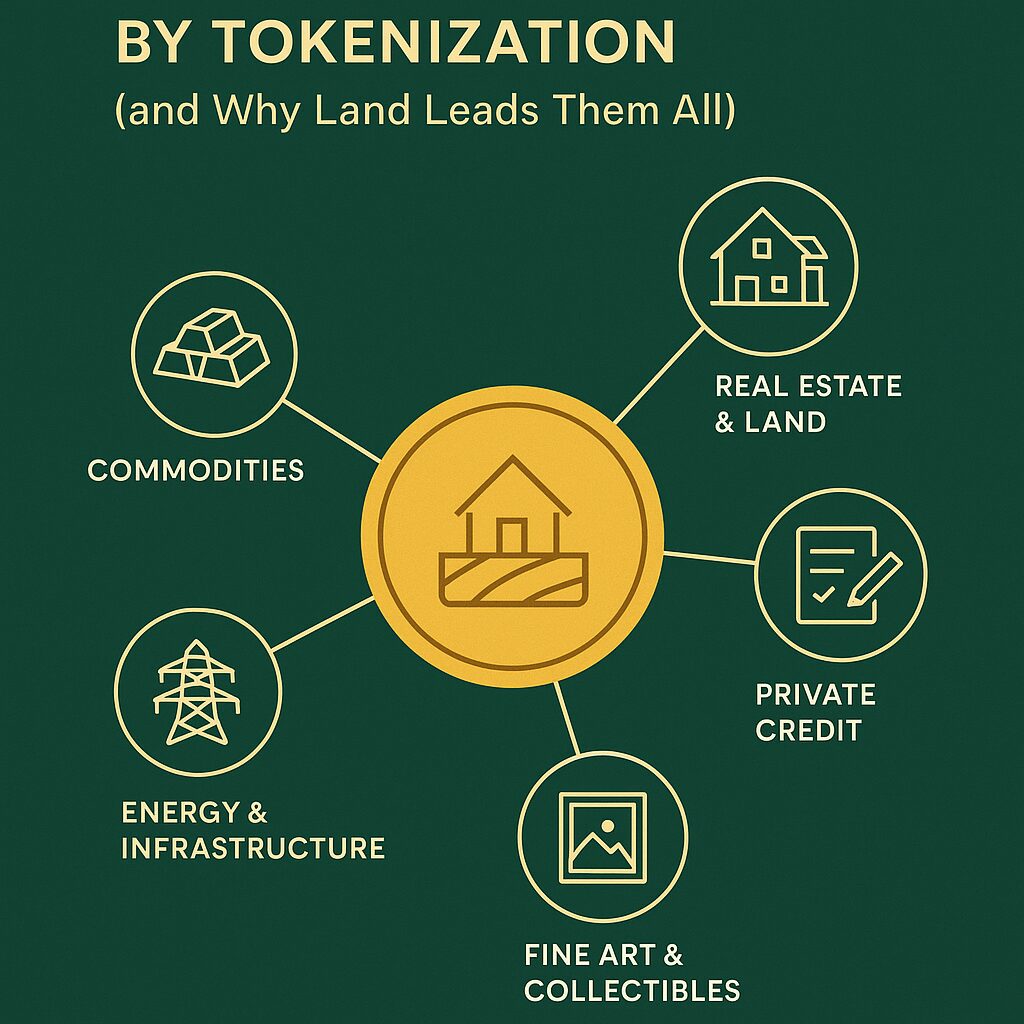

From land and real estate to credit, art, and commodities, tokenization is reshaping how people invest, trade, and transfer value across the world.

Let’s explore the top five sectors being disrupted by tokenization — and why land is emerging as the ultimate foundation of it all.

🏡 1️⃣ Real Estate & Land

It’s no surprise that real estate is leading the tokenization revolution. It’s a $300+ trillion global asset class — but also one of the least accessible.

Tokenization changes that.

By dividing ownership into digital shares, investors can buy fractions of land or property, just like buying stock.

Why Land Leads:

Land is simpler than buildings — no tenants, no maintenance, no complex leases. It’s pure, tangible value.

At LandInvest.io, the $PRPTY Security Token gives investors fractional equity in Land Invest Corp, owning real U.S. land with full legal rights, quarterly profit distributions, and SEC-compliant oversight.

✅ Accessible

✅ Stable

✅ Transparent

✅ Backed by real property deeds

Land is where RWA becomes real.

💵 2️⃣ Private Credit & Debt Markets

Private lending has long been an opaque, institution-only space.

Tokenization is breaking it open — allowing investors to access fractional exposure to short-term loans, credit pools, and real-world receivables.

Blockchain makes it possible to track repayment, distribute interest automatically, and ensure full transparency in loan performance.

Leaders in this space: Centrifuge, Goldfinch, and Maple Finance.

While these focus on credit, LandInvest.io’s model goes deeper — owning the underlying collateral (land) instead of just tokenizing the debt.

🖼️ 3️⃣ Fine Art & Collectibles

Art investing used to be limited to galleries and auction houses. Now, investors can buy tokens representing ownership in high-value art pieces — from Picasso paintings to Rolex collections.

Platforms like Masterworks and Freeport.io are leading this cultural shift.

Tokenization allows for shared ownership and secondary trading — letting art function like an asset class instead of a museum relic.

The challenge: art markets remain speculative and illiquid compared to land and credit.

⚡ 4️⃣ Energy & Infrastructure

From renewable energy credits to infrastructure projects, tokenization is helping fund global transition efforts.

Investors can now buy into solar farms, EV charging grids, or carbon credits through blockchain-based equity or yield tokens.

Why it matters:

– Democratizes access to green investments

– Enables fractional funding of large-scale projects

– Tracks production and returns transparently on-chain

Still, few assets combine tangibility, simplicity, and global demand like land.

💎 5️⃣ Commodities & Natural Resources

Commodities are being reborn on the blockchain — gold, silver, oil, and even water rights are now represented digitally.

Tokenization makes it easier to store, trade, and verify these assets globally, eliminating intermediaries and paper certificates.

Gold-backed tokens like PAXG and CACHE Gold have shown early success, paving the way for broader adoption.

But commodities face one challenge: price volatility. Land, on the other hand, has remained one of the most stable appreciating assets in history.

🌍 Why Land Is Still King

When every other asset class fluctuates, land stands firm. It’s limited, physical, and foundational to every economy on Earth.

LandInvest.io recognized this early — combining real-world ownership, blockchain transparency, and regulatory compliance under one ecosystem:

– $PRPTY Token: Security token offering equity in Land Invest Corp

– BuyVacantLand.com: Recurring subscription income stream

– Quarterly USDC Dividends: Direct, compliant, on-chain distributions

It’s the perfect marriage of old-world value and new-world access.

🚀 The Big Picture

By 2030, more than $16 trillion in assets will be tokenized. But not all assets are created equal.

Land remains:

✅ Finite in supply

✅ Easy to value

✅ Resistant to inflation

✅ Globally recognized

And thanks to LandInvest.io, for the first time ever, everyday investors can own a piece of it — one digital share at a time.

🌿 Take the Next Step

Join the movement redefining ownership and wealth.

Be part of the $PRPTY Seed Round launching November 3, 2025, and invest in the asset that started it all — land.

Visit LandInvest.io/learn to explore videos and tutorials on how tokenization is transforming global investing.

Real assets. Real compliance. Real ownership.